Leveling the Playing Field to Close the $40 Million Gap Threatening Rural Hospital Districts

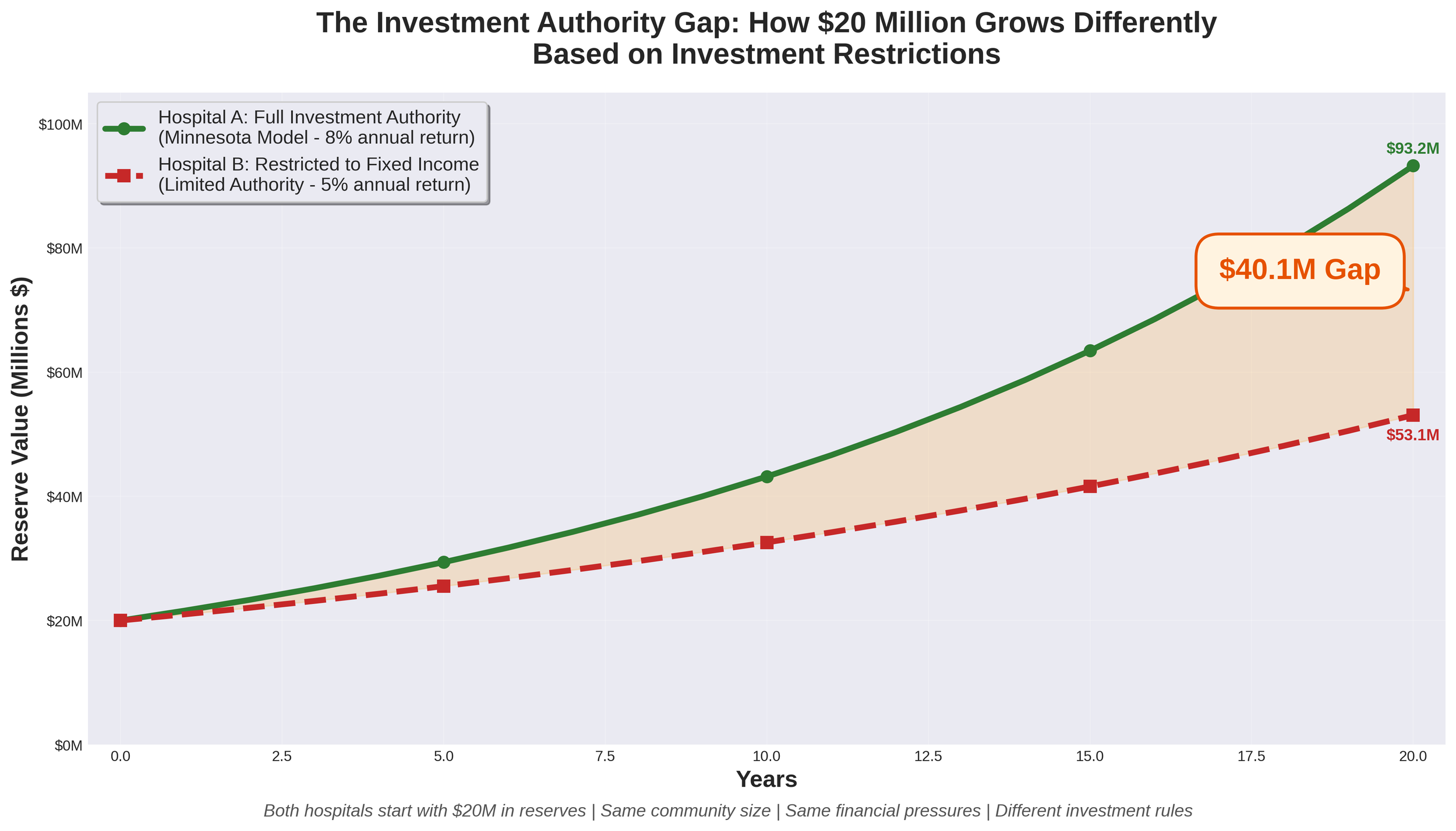

Imagine two nearly identical Critical Access Hospitals in neighboring states. Both serve rural communities of approximately 11,000 residents. Both have worked hard to build $20 million in reserves to weather financial storms and invest in their futures. Both face the same financial headwinds threatening rural healthcare nationwide.

There's just one critical difference: One hospital can invest its reserves like every other non-profit healthcare organization in America. The other cannot.

Twenty years later, the first hospital has grown its reserves to approximately $93.2 million. The second hospital has barely $53.1 million. That $40 million gap represents the difference between survival and closure for a rural community.

Rural hospitals across America are facing unprecedented financial pressures. More than 180 rural hospitals have closed nationwide since 2005, and the trend is accelerating. The challenges are well-documented: Medicare and Medicaid reimbursement rates that don't cover the cost of care, rising levels of uncompensated care as insurance coverage gaps widen, workforce shortages requiring premium compensation to recruit and retain staff, healthcare-specific inflation that outpaces general inflation (particularly for labor, pharmaceuticals, and supplies), escalating technology and cybersecurity costs, and increasing regulatory demands.

For hospital districts across many states, these universal challenges are compounded by a structural disadvantage that few people understand: constitutional or statutory restrictions that prevent them from competing on a level playing field with private non-profit hospitals. While private 501(c)(3) hospitals can invest their reserves in diversified portfolios including equities, many governmental hospital districts remain restricted to low-return fixed-income investments. This gap in investment authority creates a compounding disadvantage that threatens the long-term viability of publicly-owned rural hospitals.

Let's examine this issue using Nebraska as a case study—but the implications extend to hospital districts in any state facing similar investment restrictions.

Strengthening Rural Healthcare - Understanding the Nebraska High Value Network and Value-Based Care

On June 5, 2025, the Nebraska High Value Network (NHVN) officially launched with 19 critical-access hospitals joining forces to strengthen healthcare delivery across rural communities. This collaborative network, organized by Cibolo Health, represents more than just a partnership—it's a strategic approach to ensuring sustainable, high-quality healthcare remains accessible in rural Nebraska.

The network's cornerstone is a clinically integrated network (CIN) that will serve nearly 300,000 patients while allowing each hospital to maintain its independence and community focus. For healthcare leaders like myself, this model offers a compelling path forward in an increasingly complex healthcare landscape.